HSBC Global Equity Climate Change Fund of Fund NFO: Should you invest?

HSBC Asset Management (India) has launched HSBC Global Equity Climate Change Fund of Fund (HGECF/the scheme) – an open-ended scheme investing in HSBC Global Investment Funds – Global Equity Climate Change. The new fund offer (NFO) opened for subscription on March 3 and will close on March 17. This is the first-of-its-kind, fund of fund investing in an underlying fund which has a thematic focus on climate change. Read on to know more details.

About the fund

HSBC Global Equity Climate Change Fund of Fund (HGECF) will invest predominantly in the units of the HSBC Global Investment Funds – Global Equity Climate Change (the underlying fund). The scheme may also invest a certain proportion of its corpus in money market instruments and / or units of overnight / liquid mutual fund schemes, in order to meet liquidity requirements from time to time.

Do understand that the underlying fund – HSBC Global Investment Funds – Global Equity Climate Change – has identified nine sub-themes to address the challenges ranging from renewable energy and energy efficiency to clean transportation and natural capital. The potential investments are selected for alignment with the theme, including their carbon footprint and ESG score are checked. In addition, the holdings are diversified geographically with investments in both developed and emerging markets and all nine sub-themes.

The underlying fund undertakes detailed ESG assessment and once it is satisfied that the company has an enduring business model and a sustainable growth path the company’s stock is available for inclusion in the portfolio. The underlying fund maintains a focused portfolio of 40-60 stocks. At the moment, Energy remains bigger part of the portfolio but other themes are expected to gain. The top 10 holdings are Prysmian, Infineon Tech, Schneider Electric, Ecolab, Neste, EDP Renovaveis, Azbil, Deere & Co, Ball and Trane Technologies. The portfolio ESG score is 20 per cent greater than MSCI ACWI.

Talking about the underlying fund Angus Parker, Head of Developed Markets Equity Team, HSBC Asset Management, London, said, “HSBC Global Investment Funds – Global Equity Climate Change has a thematic focus on climate change. It invests in companies that may benefit from the transition to a low carbon economy by having a higher environmental, social, and governance rating compared to the broader global equity market. With investments in global equities, the fund offers the necessary risk diversification over the long term and can support the delivery of sustainable risk-adjusted returns.”

Fund details

Fund manager of FoF – Priyankar Sarkar

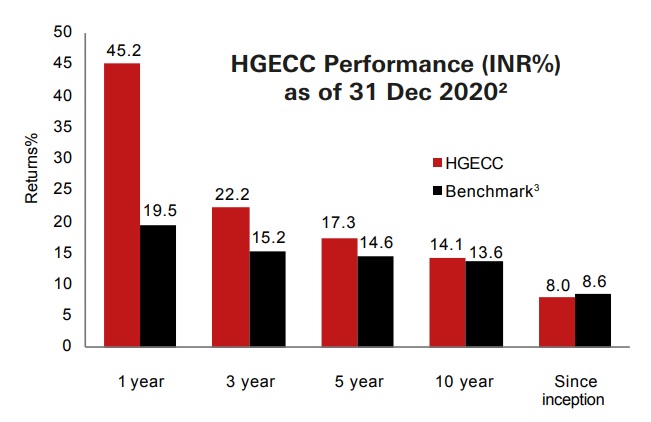

Benchmark – MSCI AC World TRI

Exit – load – 1 per cent if redeemed within 1 year

Minimum NFO investment – Rs 5,000