As per the tax laws, those individuals having income that exceeds the basic income tax exemption limit during a financial year will have to mandatorily file income tax return (ITR). The last date for filing ITR for fiscal 2020-21 (assessment year 2021-22) was 10th January, 2021. If you fille your ITR after this date you need to pay a penalty for late filing.

What are the steps in ITR filing?

The filing of ITR is a three-step process. The first step is to file your ITR. The second step is the physical or electronic verification of the ITR and the third step is the processing of your ITR by the Income Tax Department.

Why should you verify your ITR?

You need to verify your ITR within 120 days of filing it. If you do not verify your ITR within that time, you will need to file a belated return and also pay penalties for late filing.

Note that unless you verify your ITR, your return will be invalid even if you had filed it on time. Also, your ITR will be processed only if you verify the ITR. You will not receive tax refunds unless you verify the ITR. If you delay the verification, processing of your refund will also be delayed.

How to e-verify ITR?

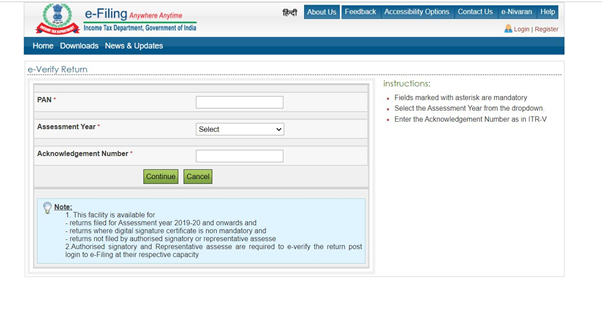

Step 1: Visit the income tax e-filing portal and click on “e-Verify Return†under Quick Links.

Step 2: Provide your PAN, the assessment year for which you want to verify the ITR and acknowledgement number that you received at the time of filing.

Step 3: Once you get the details of the uploaded return. click e-verify to start the ITR verification process.

Step 4: You can use any of the below mentioned methods to generate the e-verification code (EVC). After successfully generating the EVC, provide the EVC in ITR and click submit.

Step 5: You will see the “Return successfully e-verified†message with a transaction ID. You could download the acknowledgement. Â

How to generate EVC?

EVC is the 10-digit alphanumeric code, which is required for e-verifying your submitted ITR. Note that only one EVC can be used to verify the ITR. If you need to revise any of your ITRs, you need to generate a new EVC to e-verify your ITR.

You can use the following methods to generate EVC required to e-verify ITR.

Using Net Banking

- Login to your net banking account

- Click on the income tax filing link on the home page

- Select the e-verify option. This will redirect you to the income tax e-filing website

- Select “My Account†on the page to generate EVC

- The EVC will be sent to your registered mobile and email ID

Through ATM

- Put your debit card in the ATM

- Select the Generate PIN for e-filing option

- The EVC will be sent to your registered mobile number

By providing your Bank Account Number

- Once you click on e-verify on the e-filing website, you will see various methods to generate the EVC.

- Click Generate EVC through Bank Account Number

- Select your bank’s name, enter the IFSC code and your registered mobile number and click on “Prevalidateâ€

- Click on “Yes†to receive the EVC on your registered mobile number

Using your Demat Account Number

- Visit the income tax e-filing website and log into your account

- Click on Profile Settings

- Choose the Prevalidate Your Demat Account option

- Provide all the required data and make sure you fill the mandatory fields such as Depository Participant ID, depository type (NSDL/CDSL), Client ID, your mobile number etc.

- Click on the Prevalidate button

- Click yes to receive the EVC to your registered mobile number

Using Aadhaar OTP

- Link your Aadhaar number with your PAN

- Click on e-Verify using Aadhaar OTP on the income tax e-filing website

- The one-time password (OTP) will be sent to the registered mobile number that is linked to your Aadhaar

- Provide the OTP to e-verify your return. Note that the OTP is valid for only 10 minutes.