Offering a chance to invest in global companies listed in the U.S., Kotak Mahindra Asset Management Company Limited (Kotak Mutual Fund) has announced the launch of Kotak NASDAQ 100 Fund of Fund. Read on to know more.

NFO details

The New Fund Offer opened for subscription from 11th January, 2021 to 25th January, 2021.

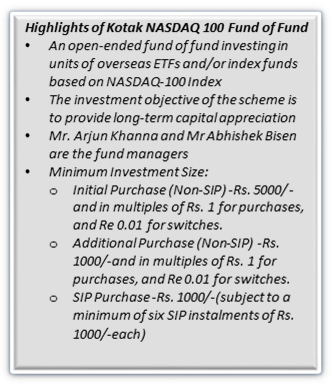

Kotak Nasdaq 100 Fund of Fund will invest in units of overseas ETFs and or funds like iShares NASDAQ 100 ETF, Lyxor NASDAQ 100 ETF and USA NASDAQ 100 Index fund (as per Scheme Information Document, i.e. SID), which in turn will invest in shares listed on the NASDAQ-100, currently worth 15 trillion USD.

Expect the Fund of Fund to have an expense ratio over and above the ETFs it invests in.

Thus, an investor in the Kotak NASDAQ 100 Fund of Fund gets an opportunity to participate in the performance of the NASDAQ 100 index.

Minimum investment (lumpsum) is Rs 5,000.

Minimum systematic investment (SIP)is Rs 1,000 for 6 months.

The NAV of the fund is Rs 10 during NFO period.

No entry or exit loads.

What is NASDAQ 100?

The NASDAQ 100 is one of the world’s major large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies based on market capitalisation which are listed on the NASDAQ Stock Exchange.

These companies are well-entrenched leaders in information technology, telecom, retail, wholesale trade and biotechnology.

The NASDAQ 100 Index in INR grew 13.7 times over last 10 years (ended Sep-2020) where as the underlying index NASDAQ 100 TRI in USD terms grew 8.2 times during the same period. The excess returns can be attributed primarily on account of depreciation of INR against USD.

The US market may appear a nice and stable performer, but when if falls, it can fall big too like the 1999-2000 dotcom crash. The NASDAQ 100 will carry these risks.

Fund outlook

Harsha Upadhyaya, President & CIO – Equity, Kotak Mahindra Asset Management Company said, “The Kotak NASDAQ 100 Fund of Fund invests in global leaders. The Kotak NASDAQ 100 Fund of Fund offers an opportunity to invest in world’s leading non-financial companies through units of overseas ETFs and/or index funds based on the NASDAQ-100 index.”

Arjun Khanna, Vice President & Fund Manager – Equity, Kotak Mahindra Asset Management Company Limited, said, “The combined market capitalisation of Apple and Amazon is more than India’s total market capitalization. Currently, 50% weightage of the NASDAQ-100 is from technology stocks. It includes companies such as Apple, Microsoft, Amazon, Tesla, Facebook and Google’s parent company Alphabet.â€

Taxation

Kotak NASDAQ 100 Fund of Fund is a debt mutual fund from a tax point of view. So gains from units less than or equal to 3 years old at the time of redemption will be taxed as per slab. Gains from older units will be taxed at 20% with cess after inflating the purchase price using the cost inflation index.

Why Buy

The NASDAQ 100 index is a wonderful offering of top global stocks.

The forex rate is a favourable factor for investors.

Also, the Fund Of Fund minimises the risks associated with direct ETF.

How Motilal Oswal NASDAQ 100 fund of fund is against Kotak NASDAQ 100 FoF

Both funds invest in the NASDAQ 100 index.

While Motilal Oswal NASDAQ 100 FoF invests directly in ETF of the same house, Kotak NASDAQ 100 FoF would invest in ETFs and index funds that invests in the NASDAQ 100 index. The Motilal Oswal fund is older, with a return since launch of 40%.

The cash drag in the FoF structure will be higher than in any ETF. SIP is the correct way to go here.