Established in 1907, Indian Bank is one of the oldest PSU banks in India. Having headquartered in Chennai, it serves over 100 million customers.

Wealthzi recommends subscribing to the perpetual bond of Indian Bank. Below are the details.

| Yield | Maturity Date | Face Value | Minimum Investment | Issued Date |

| 8.42% | 08- Dec-2025 | 10 Lacs | 10 Lacs (Approx.) | 08- Dec-2020 |

| Listed | Credit Rating | Payment Term |

| Yes | AA by CRISIL | Yearly |

Key points to note:

- This bond can be considered for medium term Investment purpose with annual returns. Coupon is 8.3 % i.e., you will receive Rs. 83,000 annual interest for every 10 lakh Investment.

- The bond issuer is PSU Bank. The Issuer has raised total Rs. 1,048 Cr from this bond in last Dec.

- It is rated AA by CRISIL with STABLE outlook.

Click here to apply for the bond

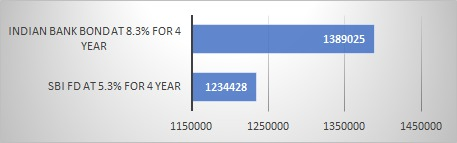

Returns compared with FD

Pre-Tax, Illustration on Every 10L Investment

About the Issuer:

The bank has flexibility to raise additional equity from the market, with the GoI stake at 88.06% as on December 31, 2020. The bank has raised Rs 2,000 crore of Tier 1 bonds and Rs 2,000 crore of Tier II bonds in the current fiscal. It is also in the process of raising additional capital in the coming quarters.

Capitalization of Indian Bank provides cushion against asset-side risks. Its net worth coverage for net NPAs was 4.3 times as on December 31, 2020 (2.4 times as on April 1, 2020).

Resource profile of Indian Bank has strengthened following its amalgamation with Allahabad Bank, with the proportion of low-cost CASA deposits at 40.9% as on December 31, 2020. Moreover, the proportion of highly stable retail deposits (retail term deposits and savings account deposits), at around 94.3% of total domestic deposits as on December 31, 2020, supports the resource profile.

Liquidity is supported by a sizeable retail deposit base that forms a significant part of the total deposits. Liquidity coverage ratio was 168.7% as on December 31, 2020, and excess statutory liquidity was Rs 43,880 crore (8.3% of Net Demand and Time Liabilities) as on January 31, 2021.