Systematic Investment Plan (SIP)Â is an easy way of investing in mutual funds. You can start investing in the best mutual fund SIP plans with as little as Rs. 100 per month. SIPs are hassle-free and straightforward. You can start investing online directly on the mutual fund website or through your broker/adviser. Investors can invest a fixed sum at regular intervals, such as weekly, monthly, or quarterly, in the top mutual fund for SIP.

Investing in mutual funds in a systematic and staggered way helps instil a sense of financial discipline in the long run. The compounding of returns helps accumulate wealth for financial goals. SIPs come with flexibility as the amount is auto-debited from your bank account. The amount debited will be invested in the mutual fund scheme you have selected.

With every SIP, units of the mutual funds are purchased at the prevailing Net Asset Value (NAV). This gets added to your investment account/folio. With SIP, you get the benefits of rupee cost averaging.

Why is SIP good for you, the investor?

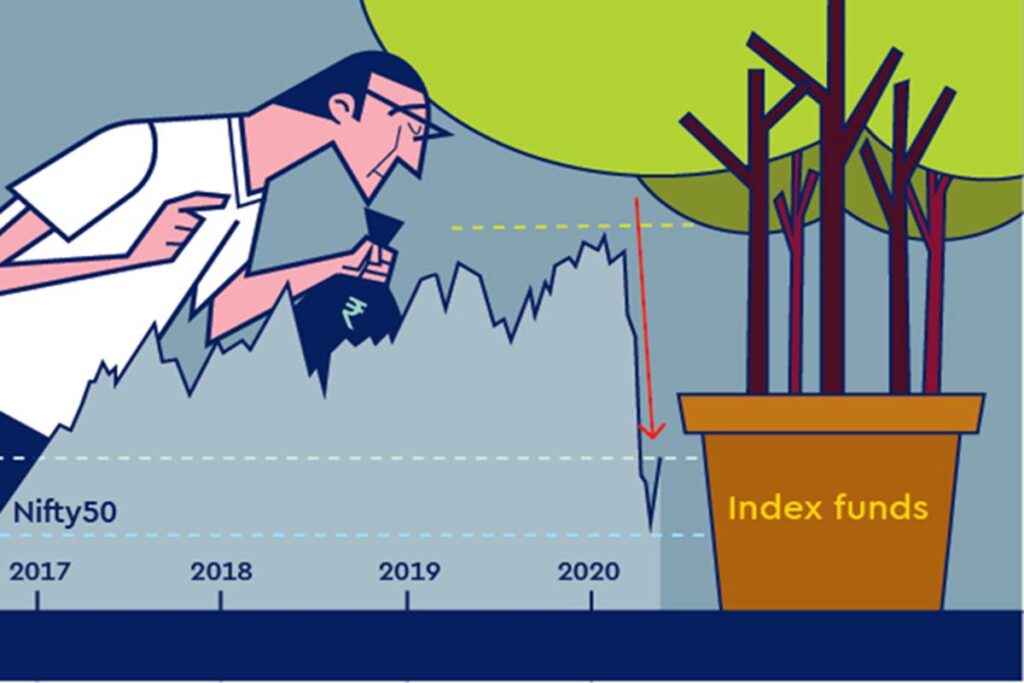

Lump sum and SIP are two ways of investing in mutual funds. While both have advantages and disadvantages, SIP has several benefits for retail investors over lumpsum investment. SIPs can be chosen by all investors regardless of their age, while lumpsum might be beneficial only to those who have a significant amount of money to invest. You don’t need to time your SIP to invest in the market. However, you may not want to invest at market peaks when you invest a lumpsum amount. You need to wait for the market to fall if you want higher returns in the long run.

SIP is investing a fixed sum at regular intervals. So, investors buy more units when the markets are low and fewer units are bought when the markets are flying high. This leads to a lower average purchase price that translates to higher returns in the long run. This is rupee cost averaging. You need to invest at a particular cycle with the lump sum investment. If you invest when the markets have already peaked, the chances of getting more returns will be low. So, the advantage of investing regularly over time makes SIP a better option.

What are the benefits of SIP plans?

Here are some reasons why people invest in the best mutual fund for SIP in India.

- Small amount – You can start investing in the best SIP plans with an amount that is as low as Rs. 100 per month. This makes SIP affordable to classes of investors. It reduces the financial risks associated with lump sum investments.

- Averaging out risks – Mutual funds invest in securities that have a degree of risk. However, when you invest in mutual funds using SIP, the market risks get reduced as the units of the mutual fund scheme are bought periodically. This means that you buy fewer units when the markets are up. So, an SIP enables you to lower the average cost of your investment and reduces the risks.

- Power of compounding – A SIP helps build wealth by investing a fixed amount of money regularly over time. So, your investment will start earning returns on the returns generated by the mutual fund if you stay invested.

- Simple process- Starting an SIP is very simple and can be done online in minutes. To make it easier, you need to give a one-time mandate to your bank for your regular contributions. Once you set up auto-debit, your mutual fund SIP plans contributions will be automatically deducted from your bank account and invested in the mutual fund scheme. You don’t need to bother about doing this every month.

Top 5 mutual fund SIP plans

We know that you are looking for the best SIP plans to invest in India. However, you can make a better decision regarding the SIP performance of the fund compared to other funds in the category.

In the coming paragraphs, we will see the performance of the best SIP mutual fund from a 3- year and 5-year horizon. We have only taken the few popular equity categories as SIP is generally used for investments in equity funds.

These funds may well be the best SIP plans for 10 years.

Flexi Cap Funds

Let us see the top performing Flexi cap SIP funds from a 3-year and 5-year returns.

Flexi cap funds are equity funds that can invest in stocks of companies that are large cap, mid cap and small cap without any restrictions. The fund manager has the flexibility to invest in various companies as per their mandate.

| Equity: Flexi Cap | ||||

| Fund Name | 3 Yr SIP Ret (%) | Fund Name | 5 Yr SIP Ret (%) | |

| Quant Flexi Cap Fund – Direct Plan | 34.15 | Quant Flexi Cap Fund – Direct Plan | 24.29 | |

| ICICI Prudential Retirement Fund – Pure Equity Plan – Direct Plan | 25.39 | Parag Parikh Flexi Cap Fund – Direct Plan | 19.07 | |

| HDFC Focused 30 Fund – Direct Plan | 24.78 | PGIM India Flexi Cap Fund – Direct Plan | 18.87 | |

| HDFC Retirement Savings Fund Equity Plan – Direct Plan | 24.57 | HDFC Retirement Savings Fund Equity Plan – Direct Plan | 17.97 | |

| Nippon India Focused Equity Fund – Direct Plan | 23.07 | IIFL Focused Equity Fund – Direct Plan | 17.57 |

So, we have seen that Quant Flexi Cap Fund and HDFC Retirement Savings Fund have made it to the top five list in both 3-year and 5-year best SIP plans in the Flexi cap category.

Another popular fund, Parag Parikh Flexi Cap Fund, comes second in the 5-year SIP return category.

Large cap funds plans

Large cap funds are equity mutual funds that invest in stocks of large cap companies. Here is the list of the best large cap funds for SIP.

| Fund Name | 3 Yr SIP Ret (%) | Fund Name | 5 Yr SIP Ret (%) |

| BHARAT 22 ETF | 23.06 | Quant Focused Fund – Direct Plan | 16.93 |

| ICICI Prudential BHARAT 22 FOF – Direct Plan | 22.66 | Nippon India ETF Nifty 50 Value 20 | 16.18 |

| Quant Focused Fund – Direct Plan | 22.64 | ICICI Prudential Nifty50 Value 20 ETF | 16.03 |

| DSP Nifty 50 Equal Weight Index Fund – Direct Plan | 19.87 | Kotak Nifty 50 Value 20 ETF | 16.03 |

| Nippon India Large Cap Fund – Direct Plan | 19.27 | Canara Robeco Bluechip Equity Fund – Direct Plan | 14.74 |

As we can see from this table, most of these large cap funds are passively managed funds, i.e., the fund tracks an underlying index. Quant Focused Fund, another fund from the house of Quant, were among the top SIP large cap plans in the 3-year and 5-year category.

The actively managed large cap funds that made it to the list are Quant Focused Fund, Nippon India Large Cap Fund and Canara Robeco Bluechip Equity Fund.

Mid-cap funds plans

Mid cap funds invest in mid-range companies that are in a growing stage. Midcap funds tend to be more volatile than large cap funds. However, this also helps these funds to earn higher returns than large cap funds.Â

| Fund Name | 3 Yr SIP Ret (%) | 5 Yr SIP Ret (%) |

| PGIM India Midcap Opportunities Fund – Direct Plan | 37.29 | 26.92 |

| Quant Mid Cap Fund – Direct Plan | 36.77 | 26.17 |

| SBI Magnum Midcap Fund – Direct Plan | 30.90 | 20.80 |

| Motilal Oswal Midcap 30 Fund – Direct Plan | 29.65 | 20.31 |

| Edelweiss Mid Cap Fund – Direct Plan | 27.50 | 19.90 |

This sector was an expectation as the best smallcap mutual fund SIP plans for 3-year and 5-year categories were the same funds, and the ranking were in the same order.Â

PGIM India Midcap Opportunities Fund topped the list of best SIP plans in India in the mid cap category.

Small Cap Funds

As the name suggests, small-cap funds invest in small-cap companies.

| Fund Name | 3 Yr SIP Ret (%) | Fund Name | 5 Yr SIP Ret (%) |

| Quant Small Cap Fund – Direct Plan | 49.68 | Quant Small Cap Fund – Direct Plan | 31.61 |

| Canara Robeco Small Cap Fund – Direct Plan | 42.49 | Kotak Small Cap Fund – Direct Plan | 25.50 |

| Nippon India Small Cap Fund – Direct Plan | 37.16 | ICICI Prudential Smallcap Fund – Direct Plan | 24.45 |

| ICICI Prudential Smallcap Fund – Direct Plan | 36.83 | Nippon India Small Cap Fund – Direct Plan | 24.30 |

| Bank of India Small Cap Fund – Direct Plan | 36.69 | Axis Small Cap Fund – Direct Plan | 24.14 |

Quant Small Cap Fund topped the category’s three-year and five-year SIP returns.

ELSS Funds

ELSS funds are tax-saving mutual funds. Investors can invest up to Rs. 1.5 lakhs and get a tax deduction under section 80C of the Indian Income Tax.

| Fund Name | 3 Yr SIP Ret (%) | Fund Name | 5 Yr SIP Ret (%) |

| Quant Tax Plan – Direct Plan | 39.17 | Quant Tax Plan – Direct Plan | 28.79 |

| IDFC Tax Advantage (ELSS) Fund – Direct Plan | 25.61 | IDFC Tax Advantage (ELSS) Fund – Direct Plan | 17.62 |

| PGIM India ELSS Tax Saver Fund – Direct Plan | 20.71 | Mirae Asset Tax Saver Fund – Direct Plan | 17.35 |

| Mahindra Manulife ELSS Kar Bachat Yojana – Direct Plan | 20.40 | Canara Robeco Equity Tax Saver Fund – Direct Plan | 17.17 |

| Mirae Asset Tax Saver Fund – Direct Plan | 20.16 | Bank of India Tax Advantage Fund – Direct Plan | 16.87 |

Quant Tax Plan, IDFC Tax Advantage (ELSS) Fund, Mirae Asset Tax Saver Fund were the top ELSS funds for SIP, as these funds made it to the top five in both three- and five-year categories.

Looking for more mutual fund SIP plans ? By investing in some of the best SIP plans, you can hope to get higher returns in the long run from your investments. Click here to explore the best funds.