Understanding SEBI’s new Riskometer for mutual funds

Based on the recommendations of the Mutual Fund Advisory Committee (MFAC), the Securities Exchange Board of India (SEBI) has made changes to the product labelling of mutual funds. If you didn’t know, fund houses label their fund categories based on SEBI’s ‘Riskometer’. This meter will show the level of risk to the principal amount invested in a category of mutual fund schemes.

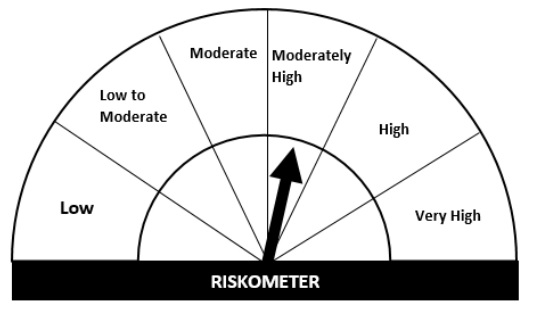

Earlier the Riskometer had five categories: Low risk, Moderately low risk, Moderate risk, Moderately high risk and High risk.

Now, SEBI has added a category called ‘Very high risk’.

Another change is that mutual fund houses now have to provide the risk label for their schemes and not for a particular category of schemes. So, the Riskometer will actually show the risk of investing in a scheme based on the fund’s actual portfolio.

The calculations of the risk levels for the mutual fund schemes will be based on the methodology provided by SEBI. So, when will these risk levels be determined? Mutual fund houses will look at the characteristics of the schemes and provide a risk level at the time of launch of the scheme or during the New Fund Offer (NFO). The ‘Riskometer’ of the schemes will be updated on a monthly basis on the fund house’s website and on the Association of Mutual Funds India (AMFI) website.

Where else can you find info on the scheme’s Riskometer?

The front page of the NFO supplication form will have the risk label of the scheme. You can find it on the Scheme Information Documents (SID) and the Key Information Memorandum (KIM). You can get the risk label from the Common application form provided by the fund house. Fund houses have to place the risk label near the caption of the scheme. The label has to be prominently visible. So, you can easily find it. You can find the risk label on scheme advertisements too.

When will the information be updated?

Fund houses have to update the risk label for the scheme within 10 days from the end of the month. Asset Management Companies (AMC) will need to publish all the historical changes to the Riskometer annually.

What happens when there is a change in the risk levels of the scheme?

If there is any change in the Riskometer of the scheme, it will have to be communicated to the unitholders of the mutual fund scheme. This could be done using Notice cum addendum and using email or SMS.

When are these SEBI changes coming into effect?

These are applicable from January 1, 2021 to all existing schemes and all schemes that will be launched from that date. However, fund houses can start using the new provisions even before the effective date.

How does this help the investor?

Once mutual funds start using this Riskometer, investors will find that debt funds holding higher maturity papers or having lower credit rating will be tagged as higher risk schemes. What about equity funds? Higher risk tags will be given to small cap and mid cap mutual funds. So, investors can avoid investing in those schemes that have a higher risk element. Another point is the liquidity of the schemes. As you might know, illiquid mutual fund schemes have a higher risk. SEBI’s new guidelines gives importance to the liquidity of the scheme. This is for both equity and debt funds. So, any mutual fund scheme that has illiquid investments in its portfolio will be designated as having higher risks on the Riskometer.

As a mutual fund investor, you should invest in mutual fund schemes based on your own risk profile. The Riskometer will help you choose schemes that match your risk profile. However, you must understand that risk and return are inversely correlated. So, if you want higher returns, you will need to invest in riskier funds. SEBI’s new guidelines on scheme risks will help you make a more informed investment decision.

What are the new labelling guidelines for dividend options?

Another development is that SEBI has now launched labelling guidelines for dividend options that mutual funds provide. Under these guidelines, fund houses will need to rename them as pay-out of income distribution cum capital withdrawal for dividend pay-out, reinvestment of income distribution cum capital withdrawal for the dividend reinvestment option and the dividend transfer plan will be known as transfer of income distribution cum capital withdrawal.

Why this change? This is because a mutual fund investor needs to understand that if he/she chooses any of the dividend options, a certain portion of the investor’s capital can be used for the dividend option.

Presently, fund houses can distribute dividends from the gains realised by the mutual fund scheme or from equalisation reserve that is included in the sale price of the mutual fund. When the dividend is declared, the Consolidated Account Statement of the mutual fund will need to have a clear differentiation between appreciation in the Net Asset Value (NAV) (which will be income distribution) and equalisation reserve (which is capital distribution).